Illinois Unemployment Wage Base 2025. Click on the plus icon to expand the table and view additional column data. Several states have released their state unemployment insurance taxable.

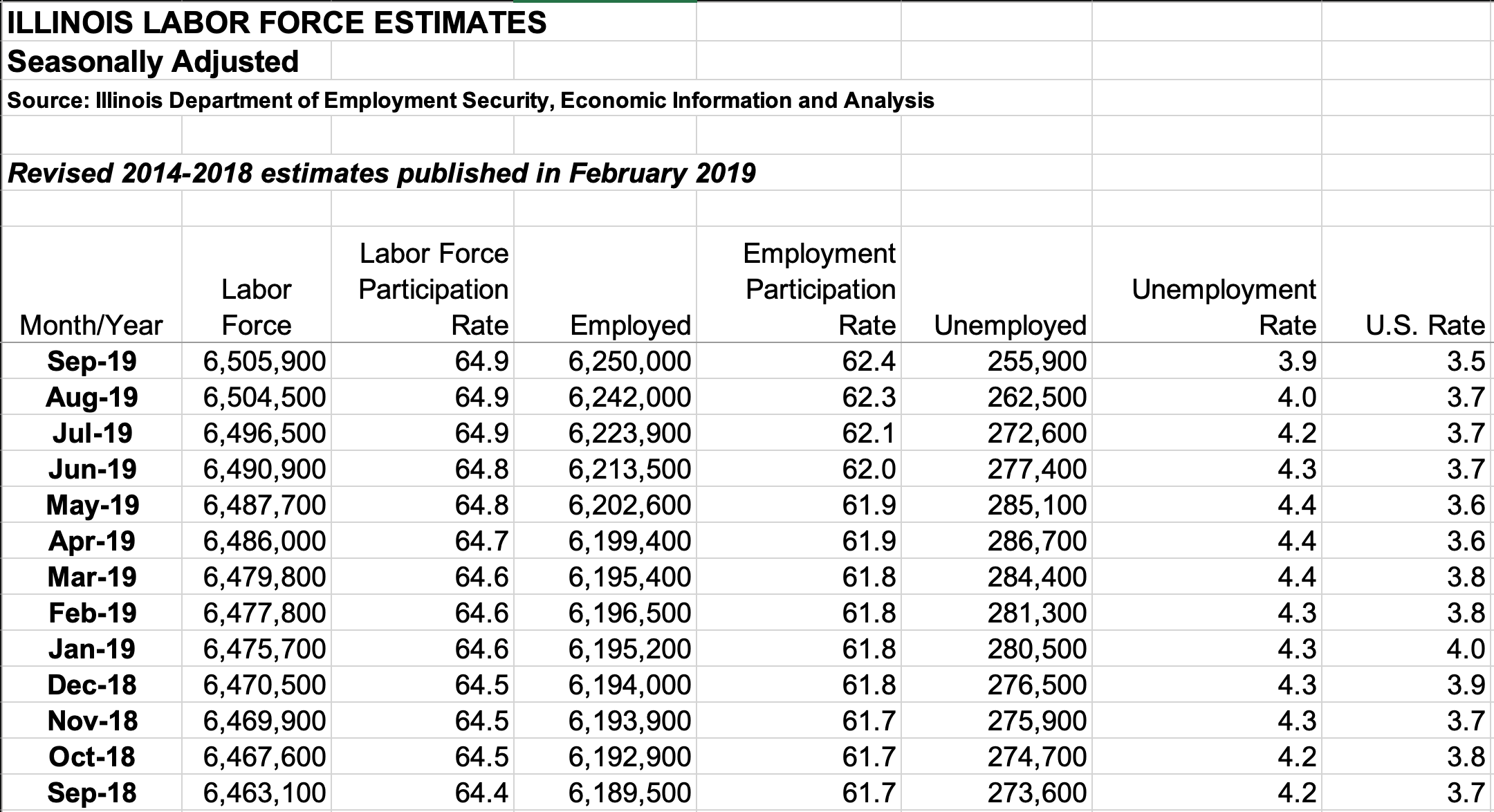

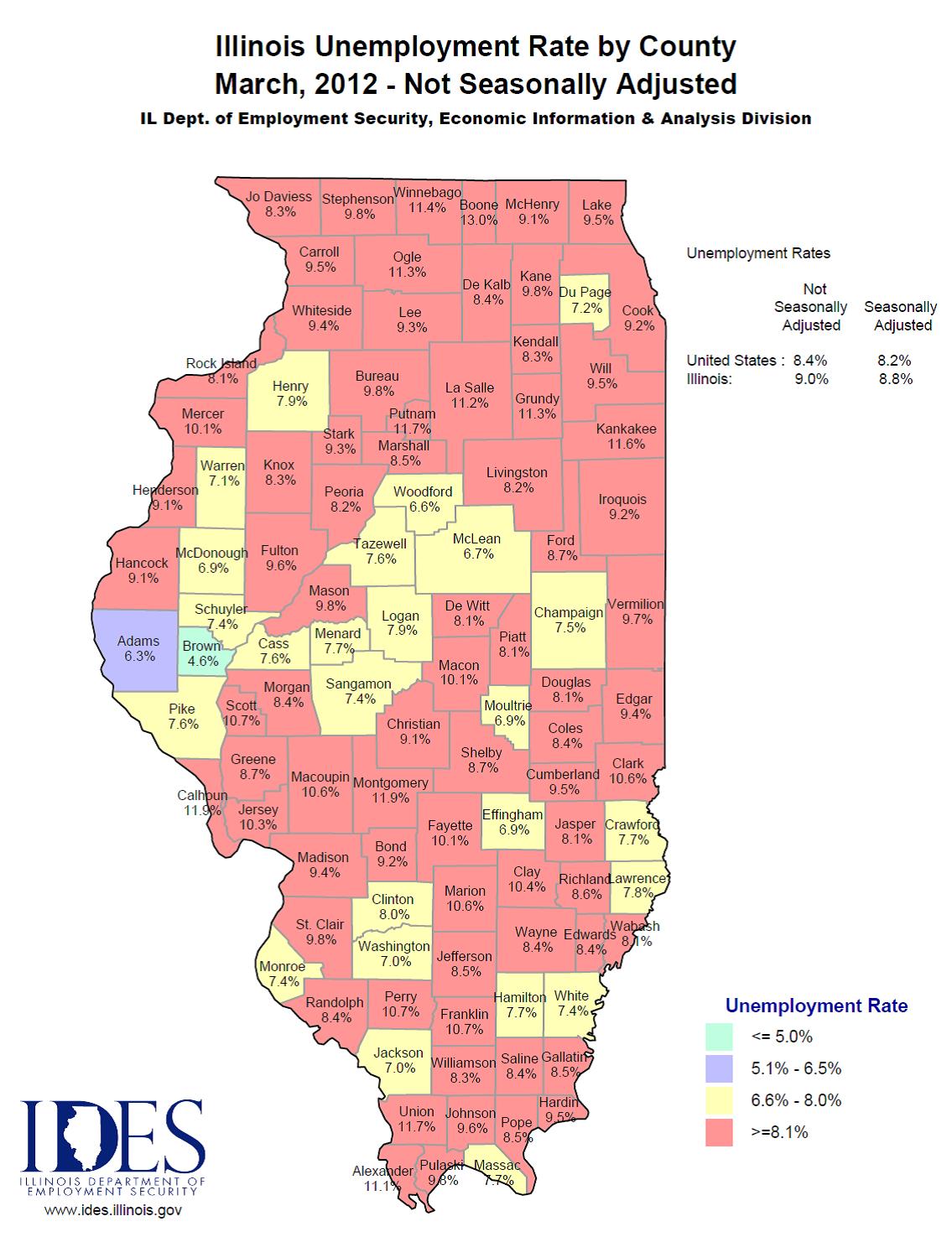

(includes current, previous and year ago monthly unemployment rates for state, u.s., metropolitan areas, counties, cities, micropolitan areas, combined areas, local workforce. State unemployment insurance taxes are based on a percentage of the taxable wages an employer pays.

An updated chart of state taxable wage bases for 2025 to 2025 (as of february 7, 2025) may be downloaded from the payroll.org website.

Unemployment Extension 2025 Illinois Latest News Update, The federal unemployment tax act (futa) requires that each state’s taxable wage base must at least equal the futa wage base of $7,000 per employee, although most states’ wage bases exceed the required amount. Illinois unemployment insurance (bloomberg tax subscription).

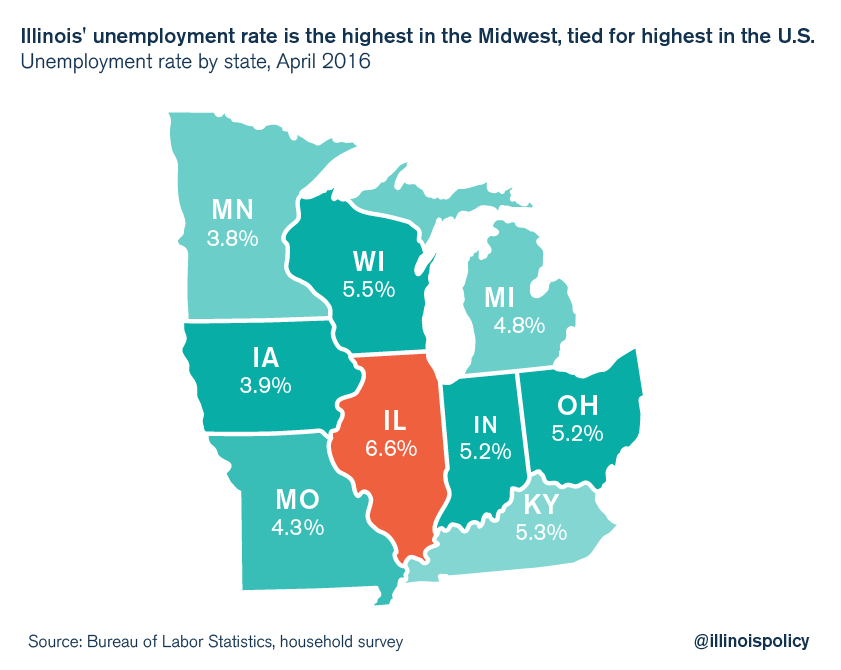

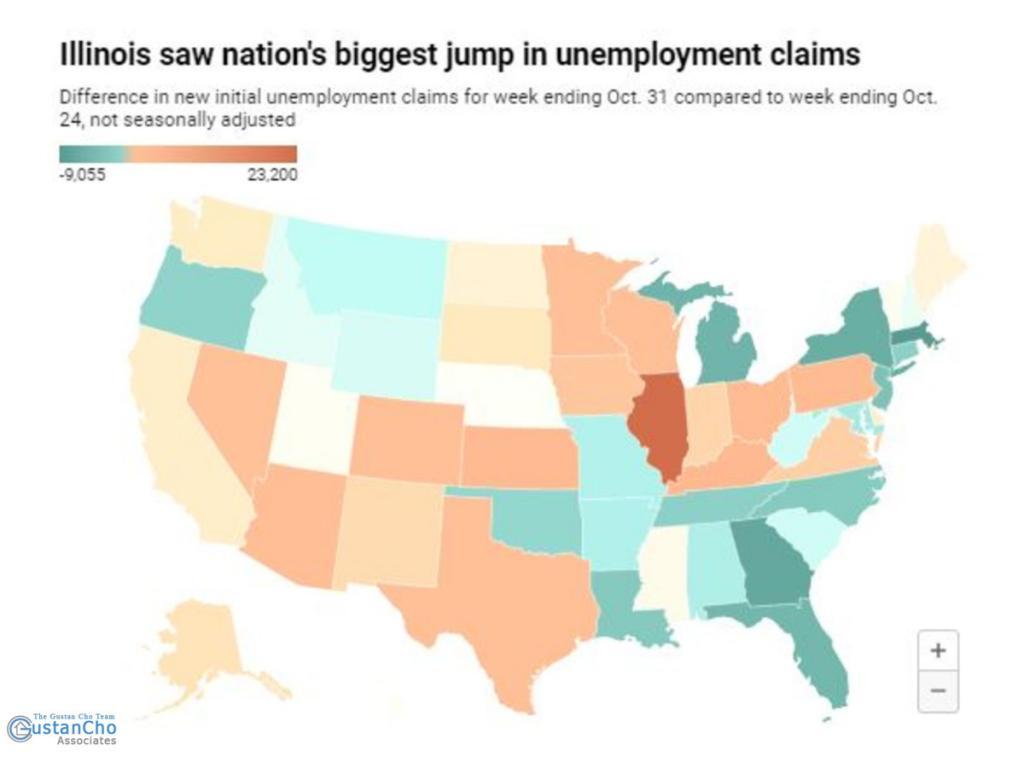

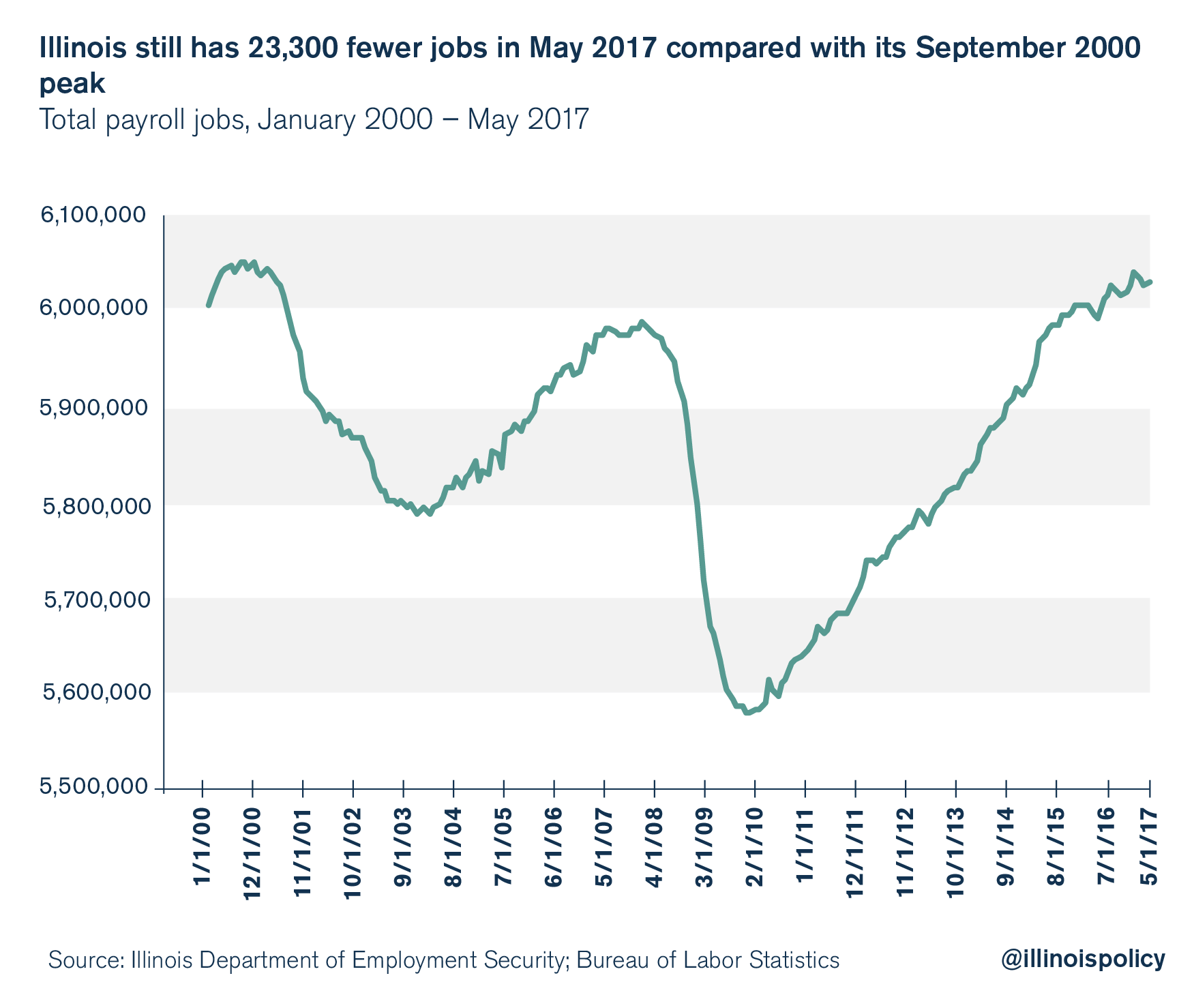

Illinois has highest unemployment rate in nation, Apr 19 2025, 10:30 edt. Mar 22 2025, 10:33 edt.

Illinois Unemployment Drops To "Record Low," Preliminary Data Shows WSIU, Apr 19 2025, 10:30 edt. State unemployment insurance taxable wage bases for 2025.

Illinois unemployment highest in U.S. for 2nd month The Barrington, Click on the plus icon to expand the table and view additional column data. Mar 22 2025, 10:33 edt.

What Is The Ui Rate For Illinois Yuri Shwedoff, It can range from as low as 0% to as high as 20%, depending on your state and your company’s unemployment history. Find the latest prevailing wage rates for fiscal year 2025 in illinois by county, trade and classification.

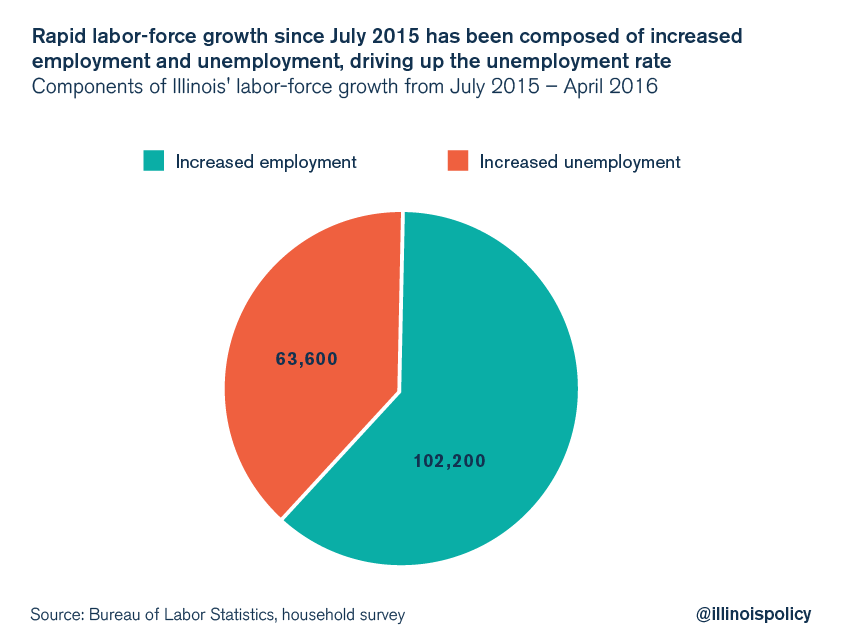

Illinois Leads Nation With Highest Unemployment Numbers, The federal unemployment tax act. State unemployment insurance taxable wage bases for 2025.

Guide To Claiming Unemployment Benefits, To access the chart from the. The proposal would also increase the threshold salary for highly compensated employees from $107,432 to $143,988 per year.

How Much Are Illinois Unemployment Benefits, The below applies to many employers except 501 (c) (3) organizations. The proposal would also increase the threshold salary for highly compensated employees from $107,432 to $143,988 per year.

Illinois has highest unemployment rate in nation, Illinois unemployment insurance (bloomberg tax subscription) illinois released its 2025 unemployment insurance tax. The federal unemployment tax act.