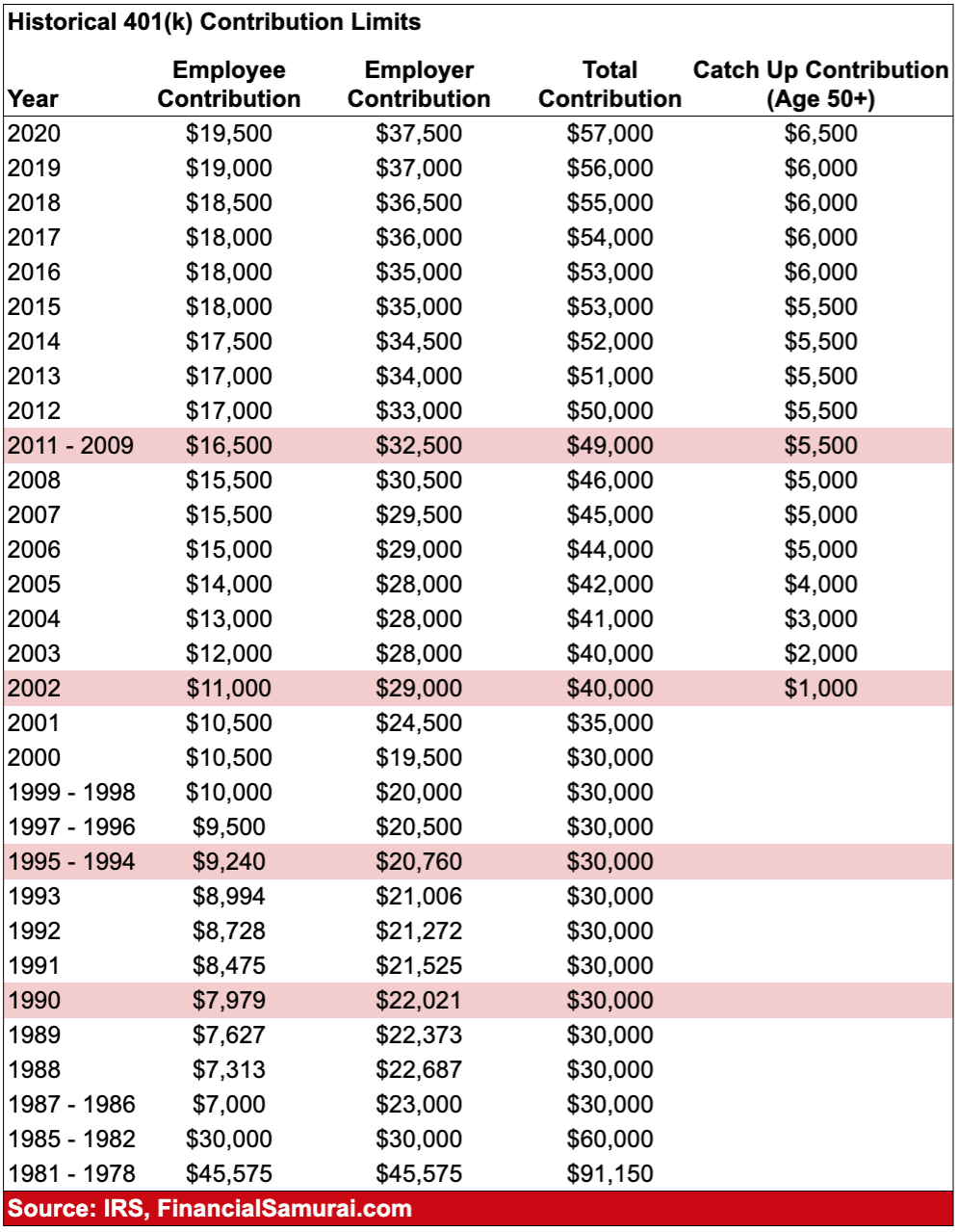

401k Catch Up 2025 Calculator. Some 401 (k)s allow added savings beyond those limits. The annual maximum is $23,000 in 2025.

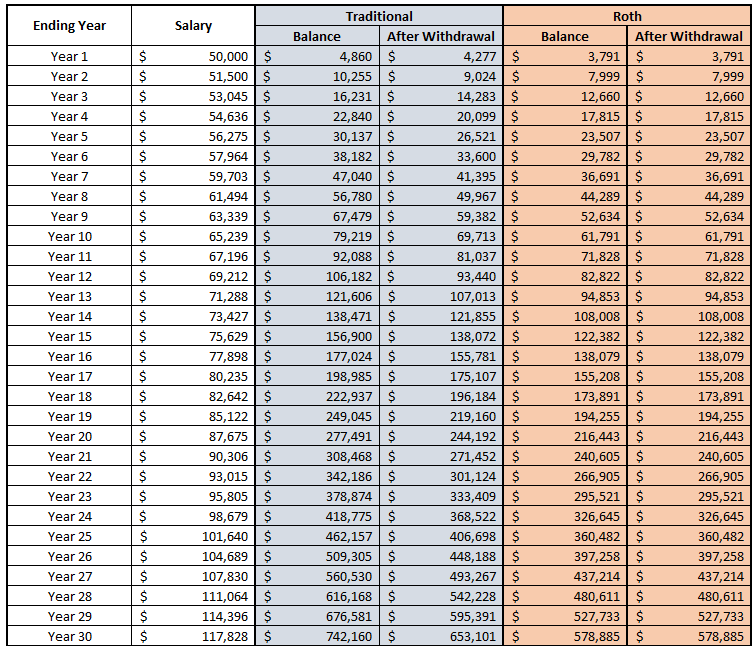

The calculator assumes that you deposit every month and that your return is compounded. The limit for overall contributions—including the employer match—is 100% of your compensation or $69,000,.

401k Catch Up 2025 Calculator Neysa Adrienne, Employer contributions do not go toward an employee’s maximum annual contribution limit.

matching example_ Boeing.png?width=4960&name=401(k) matching example_ Boeing.png)

401k Max Contribution 2025 Calculator Single Ardis Britney, Estimate the way that you expect your 401k investments to grow on an annual basis in percentage terms.

Retirement Tax Calculator 2025 Tanya Aloysia, It takes into account various factors such as your current age, income, existing savings, contributions, employer match, and investment growth.

Maximum 401k Contribution 2025 With Catch Up Gael Sallyann, Every year, by regulation, the irs revises how much you can contribute to your retirement plan that year.

2025 401k Limits Catch Up Irs Averyl Gabrielle, Employer contributions do not go toward an employee’s maximum annual contribution limit.

401k Catch Up 2025 Gerry Kimbra, If you are 50 years of age or older and are already contributing the maximum amount permitted by your plan, you can contribute up to an additional $6,000 annually.

2025 401k Limits Catch Up Irs Averyl Gabrielle, This 401 (k) calculator is designed to help you estimate how much money you could have in your 401 (k) retirement account by the time you retire.

2025 401k Catch Up Amount Billye Katherine, Those 50 and older can contribute an additional $7,500.